who do i call about a state tax levy

If you need tax forms for your state you can get access to all the necessary forms in one place. Call us today for a free consultation and to get more information about state tax problems and tax.

Irs Tax Lien Vs Irs Tax Levy What S The Difference Call Maryland Tax Attorney Charles Dillon

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the IRS right away.

. Entering a payment arrangement paying in full and successfully seeking hardship status will result in levy release. You dont have to face your state tax levy problem alone. A property tax levy is the right to seize an asset as a substitute for.

State tax levies can come in the form of a wage garnishment bank account seizures and property seizure. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for. You can contact the SCDOR office near you to request a Payment Plan Agreement for business taxes.

Levies If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. A state tax levy is the states way of forcibly seizing your assets. For the status of your state tax.

The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance. OR To request a Payment Plan Agreement by paper print and mail a completed FS-102. A tax levy is a legal seizure of your property by the IRS or state taxation authorities.

Liens are filed with the county Register of Deeds andor the Secretary of State as security that a debt will be paid from proceeds when a taxpayer sells real or personal property. An IRS tax levy is a legal seizure of your property to compensate for your tax. Resolving your federal tax liabilities with your citymunicipal tax refund through the.

If you need additional help appealing a tax levy in order to get it released ask a certified public accountant CPA Enrolled Agent EA or local tax attorney how to proceed. How do I contact the IRS about a levy. Refer to our state tax relief section to resolve a tax levy in your particular state.

It is different from a lien while a lien makes a claim to your assets as. California taxpayers can take advantage of several ways to get. Tax levies are collection methods used by the IRS where they can legally seize your assets to cover back taxes.

Omni Tax Solutions is here to help. Federal and State Levy Programs If your federal payments state income tax refund or Alaska Permanent Fund Dividend have been levied this section will give you information on who to call.

Can The Irs Levy Or Garnish My Bank Accounts Tax Attorney Newport Beach Ca Orange County Dwl Tax Law Daniel Layton

Wauseon Schools Release Faq About Levy Fulton County Expositor

Irs Bank Levy Release Services Lifeback Tax

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

The Tax Levy Limit When Is 2 Not Really 2

Washington Dc Irs Tax Levy Lawyer Levied Taxes Attorney

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Levy Release Archives 20 20 Tax Resolution

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Irs Levy Tax Matters Solutions Llc

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

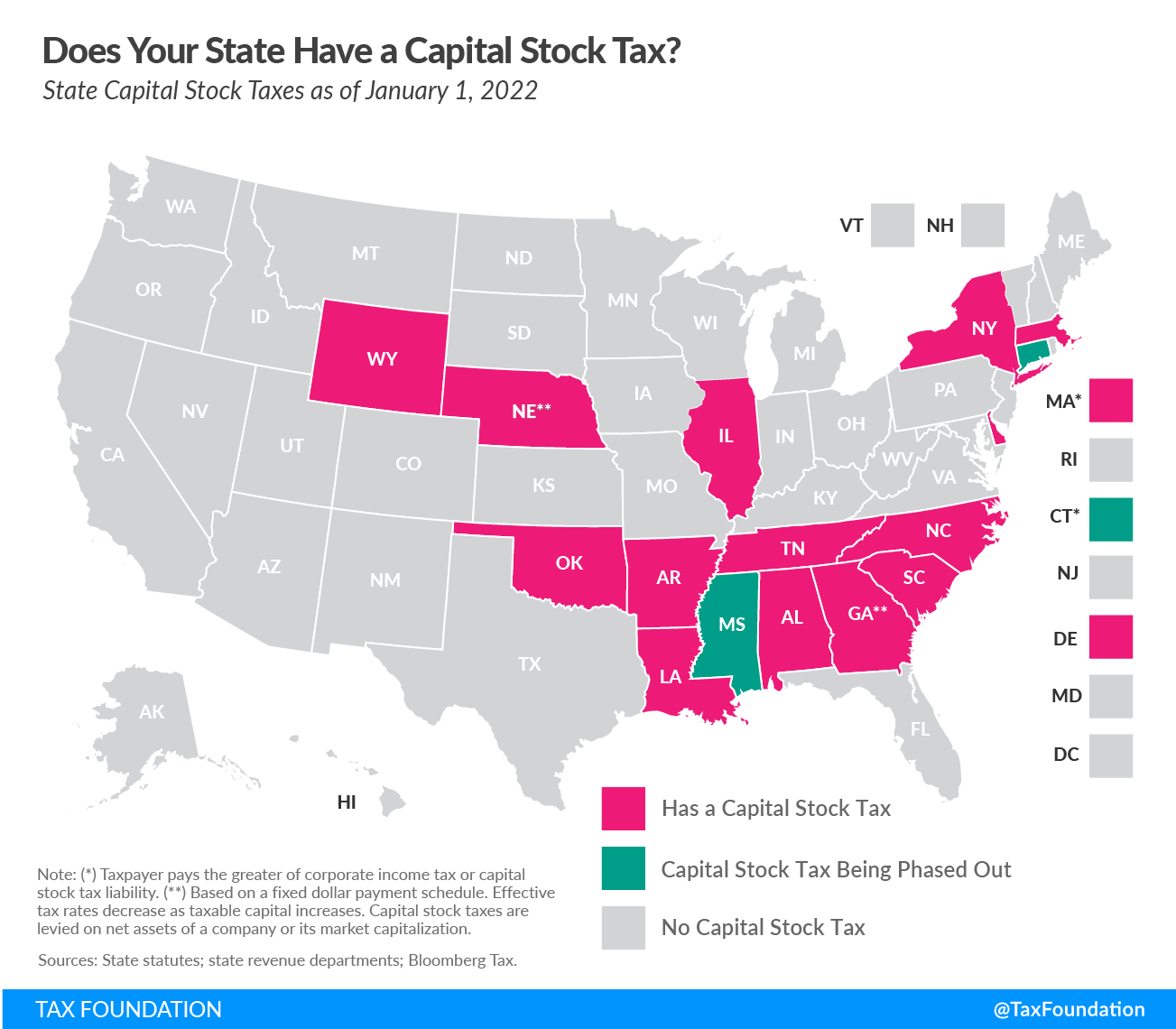

Does Your State Levy A Capital Stock Tax Tax Foundation

Department Of Revenue Warns Of Tax Scams Montana Department Of Revenue

Irs Tax Notices Explained Landmark Tax Group

Who Do I Call About An Irs Tax Levy

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Irs State Tax Levy Guide How They Work How To Stop Help